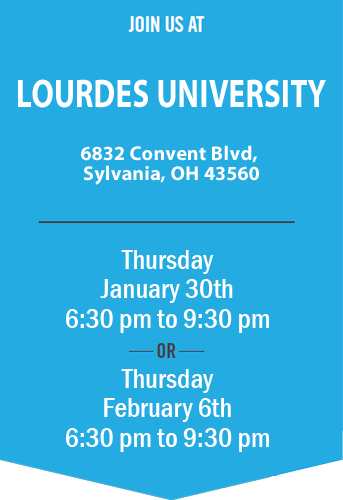

The Changing World of Retirement Planningtm

Register by Calling 419.491.0909

MACINO FINANCIAL SERVICES

Retirement Planning – Financial Advisor

Financial stability, financial security, financial independence; this is what we strive to provide each and every one of our clients.

You need an experienced retirement advisor. We serve the entire Toledo, Ohio metro area & are here for you.

Call us to start your consultation today! 419.491.0909

Financial Planning

Social Security, Retirement, 401K Retirement & Insurance Planning. Wealth Transfer, College & Savings Planning. Charitable Giving. IRA

How We Help Our Clients

At Macino Financial, we believe that fully understanding your current financial situation is vital to successfully making prudent decisions concerning your economic future. Call us today at 419.491.0909 to make an appointment.

News Posts

The New Mortgage Insurance Coverage That Insurers Don’t Want You Knowing

14 AugustInsurers Don’t Want Seniors Knowing This…… It’s not something any of us like to think about ...

Your 401(k) Is Just as Important as Your Health

23 JulyAuthor: Sarah Howard We have collectively experienced the impact the COVID-19 pandemic has had on th...